RS commits almost a billion to partner with Chase Asia,

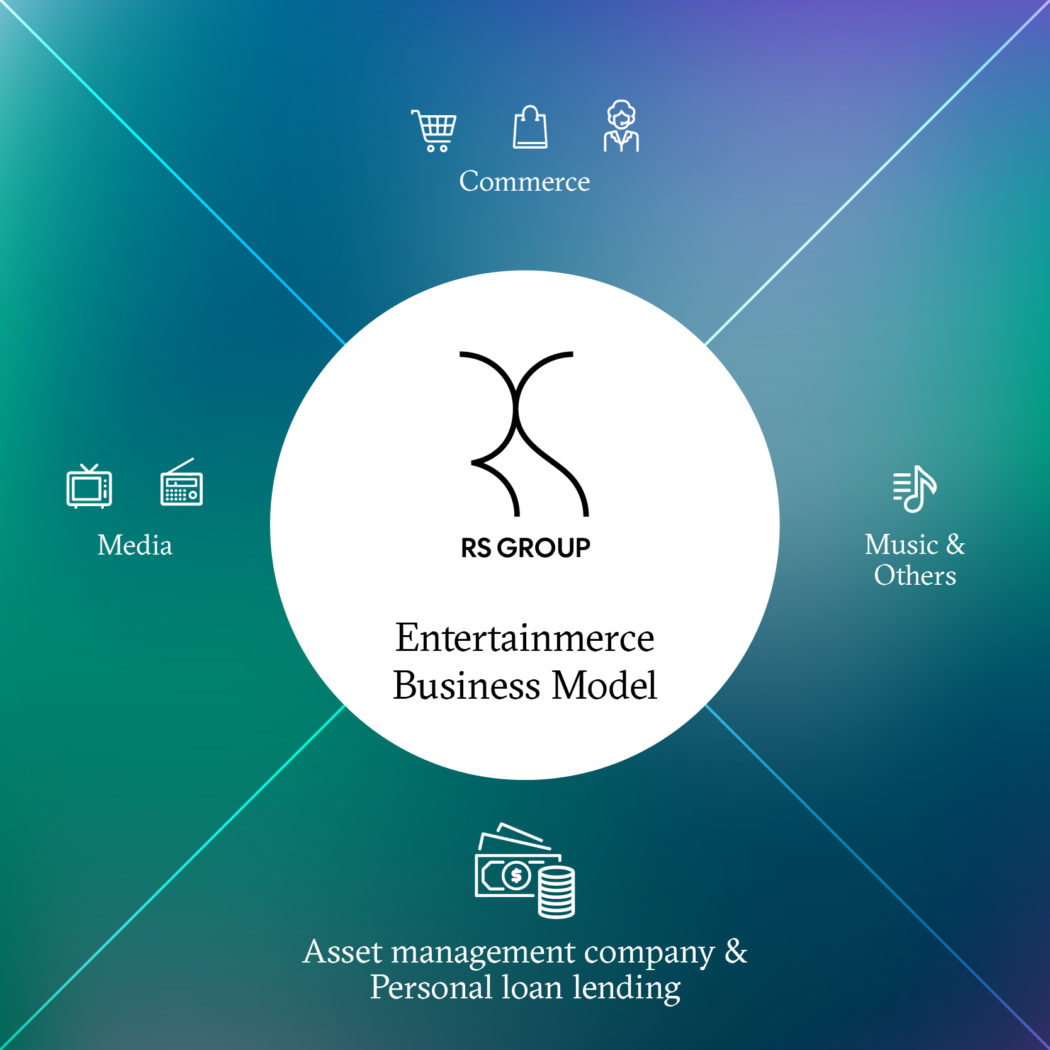

Moving forward to a new sector, “Asset management company & Personal loan lending.”

Extending the Entertainmerce Model to trigger new S-Curve and achieve enormous growth

RS Group declares business expansion by acquiring a 35% share of Chase Asia Co., Ltd., an asset management & personal loan lending service, with an investment total of 920 million baht. This investment was made by RSX, a wholly owned subsidiary of RS Group. The effort creates the new S-Curve and contributes to an even more powerful synergy from the resources and strength that both RS Group and Chase Asia possess and share. The partnership makes a huge difference and expands the Entertainmerce model of RS Group in various dimensions. It is a move that creates the income from a new business, shares resources and strength of the entertainment, media, and commerce sectors more effectively. This investment is a purchase of new ordinary shares, resulting in healthy cash flow for Chase Asia to expand its business.

Surachai Chetchotisak, Chief Executive Officer of RS Group, shared his view that “in order to advance to the new era and create the new S-Curve, mergers and acquisitions (M&A) are a key strategy to broaden the ecosystem instantly. By increasing the business value, this strategy improves business competitiveness and long-term sustainable stability. In this investment, RS Group committed 920 million baht by borrowing from a financial institution. The financial status of the Company is very healthy. We have very high fluidity and can enhance the growth and expansion of the Company in a long run.”

The reasons RS bought shares of Chase Asia Co., Ltd.

Based on the prospect of the current economic trend, the number of non-performing loans tends to increase. RS Group sees this as an opportunity to expand the Entertainment model and thus decides to buy the shares of Chase Asia Co., Ltd. The acquisition of Chase Asia consists of three subsidiaries (holding 100% of shares), namely Resolution Way Co., Ltd., CF Asia Asset Management Co., Ltd., and Courts Megastore (Thailand) Co., Ltd., or collectively referred to as Chase. The core business of the Company are as follows:

- All-inclusive debt management and consultation of debt management are run by Chase Asia Co., Ltd. There are a total of over 400 staff in the call center units and 100 debt collectors and managers for the service. Currently, the value of the asset collection is around 45,000 million baht, with more than 300,000 accounts of debtors. The main customers are financial institutes and non-financial institutes.

- Asset management, acquisition, transfer, and NPL management from financial institute and non-financial institute. The subsidiaries include CF Asia Asset Management Co., Ltd., with the license granted by the Bank of Thailand (BOT) and Resolution Way Co., Ltd. Currently, the portfolio of the debt has a value of over 27,000 million baht with more than 100,000 accounts.

- Personal loan business under subsidiaries, namely Resolution Way Co., Ltd. under supervision of the Bank of Thailand and Courts Megastore (Thailand) Co., Ltd. The subsidiaries operate the loaning business under the Civil and Commercial Code. The current asset is worth 300 – 400 million baht, including more than 1,000 accounts.

Benefits from the investment

Chase Asia operates an all-inclusive business, ranging from NPL management, debt collection, legal execution, and retail loans. The goal of the Company is to achieve robust growth. With professional and experienced executives and employees, Chase Asia is expected to bring healthy return on investment to RS Group. In the past year, it is estimated that Chase Asia has a total revenue of approximately 600 – 700 million baht and a net profit of 150 – 200 million baht. Therefore, this acquisition of RS Group is a significant step of investment in the new business industry. It is a golden opportunity to enhance the growth of the Company. This is because Chase Asia has a high potential to grow and has a solid plan to manage debt management and retail loan constantly in the future.

“Also, the partnership of both company groups guarantee a strong synergy from the mutual exploitation of resources and strength of each Company in terms of selling channels, data management systems, and ecosystem of RS Group, as well as the expertise in the industry and Chase Asia’s image in the industry. All these factors will benefit both companies in customer base expansion, selling channels, media, and marking strategies that meet the right demands. This will make a huge difference and expand the Entertainmerce model and ensure the growth of Chase Asia in the future. In the positive prospect, Chase might have such a robust growth that it can be a leader in the industry and become a listed company in the Stock Exchange of Thailand (SET) within three years”, said Mr. Surachai.

###

About RS Group

RS Group is the pioneer and has been the inspiration of Thai entertainment culture since 1982. Today, RS Group is categorized in the commerce sector in the Stock Exchange of Thailand. Its core business categories are commerce business and media and entertainment business. The commerce business includes RS Mall and Lifestar Co., Ltd., while the media and entertainment business includes Thai television Channel 8, COOLISM radio station, and RS Music. The enterprise is operated under the model so-called Entertainmerce. That is to say, the strength of the media and entertainment business is drawn out to support the commerce business. This model incorporates all the subsidiaries conclusively and promotes the growth of all subsidiaries at the same time. Currently, RS Mall has more than 1.6 million customers and 600 tele-sale agents. The Company uses big data to analyze and develop the product presentation method that meets the customers’ needs and the predictive dialing system (PDS) to create an effective call center. It is a powerful and significant strength. RS is so successful that it is praised as a case study in adapting to innovative change to become a leader of the changing business world. It is a pride that we are not the entertainment media that inspire the customers directly but also offer the products that satisfy the customers’ needs.

About Chase Asia Co., Ltd.

Established in 1998, Chase Asia has long experience in legal execution, debt collection, and seeking of debtors’ assets. The first groups of customers were initially limited only to financial institutes. In 2003, Chase Asia founded Resolution Way Co., Ltd. to buy non-performing loans to manage. The newly-founded Company has since been licensed to transact the business of personal loans under the supervision of the Bank of Thailand. In 2012, Chase Asia instituted CF Asia Asset Management Co., Ltd. because the Company sees the opportunity to operate the financial business. Some financial institutes and hire-purchase companies have a policy to reduce the ratio of NPL. In 2013, C F Asia Asset Management was registered with the Bank of Thailand to operate the asset management business according to the Act on Asset Management Company. Later in 2015, the Company purchased the business of Courts Megastore (Thailand) Co., Ltd. from the old foreign shareholders. Initially, the corporate ran the business of loans for electrical devices to personal loans until today.